However, instead of creating zero-dollar checks, we record a zero-dollar GL entry each week. We record job costs in a manner that appears to be somewhat similar to what you suggest in this post, in that it relies on the zero-dollar concept. The Excel workbook is massaged a little bit each week, then uploaded to our payroll processor, which prepares the checks and provides a journal entry to record the necessary entries. I work for a construction company with about 60 employees. To see this technique in action, watch this video from the Sleeter Group.

How much is quickbooks payroll service full#

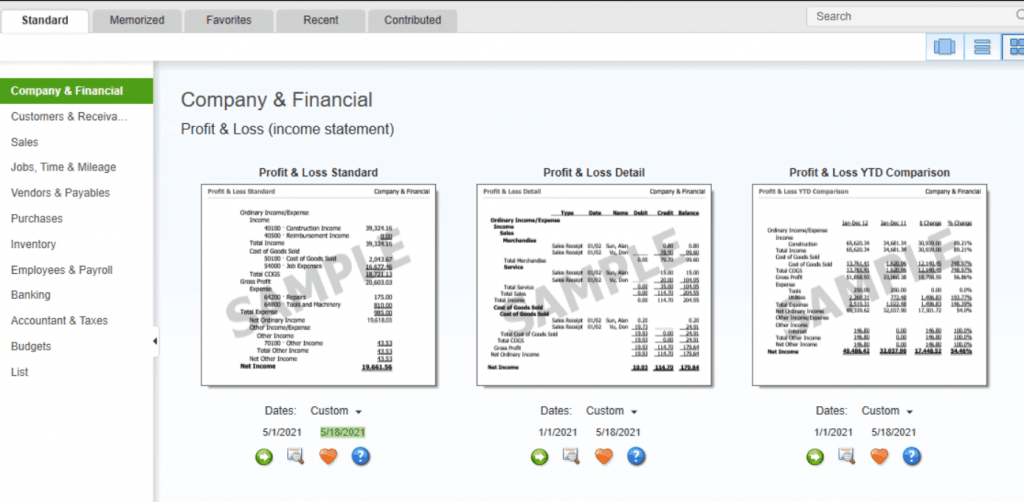

You have to use a workaround! Job Costing in QuickBooks Workaround Create Two New Accounts in Your Chart of Accounts In these scenarios, your payroll expenses don’t show up on your Profit & Loss report, even if you assign them to Customer:Jobs. If you’re using Intuit Payroll through QuickBooks, and using Timesheets to track Employee Hours, applying those hours to a Customer: Job is automatic, and Job Costing reports show your profit margin.īut if you’re like most small businesses, you use an outside payroll service such as ADP, your accountant process your payroll, or you just write checks yourself. Sometimes you may feel like you made a bunch of money, but not realize that your labor costs were so high that you barely made a profit!

How much is quickbooks payroll service professional#

If you’re a contractor or other professional who really wants to know if you’re making any money on the jobs you do, Job Costing is essential, especially if your job expenses include payroll. It allows to you see if a project was profitable or not. QuickBooks has a powerful Job Costing feature that allows you to compare the income you made from a job to the expenses you incurred to provide the product or service.

0 kommentar(er)

0 kommentar(er)